(AB Wire)

One of the clearest options for overseas Indians is to travel back to India to exchange the notes in person.

In the past week, ever since the Government of India announced that they will be phasing out the 500 and 1,000 ($7.35; $14.70 ) Indian rupee denominations to combat corruption and the “black money” economy, my inbox and phone have been off the hook.

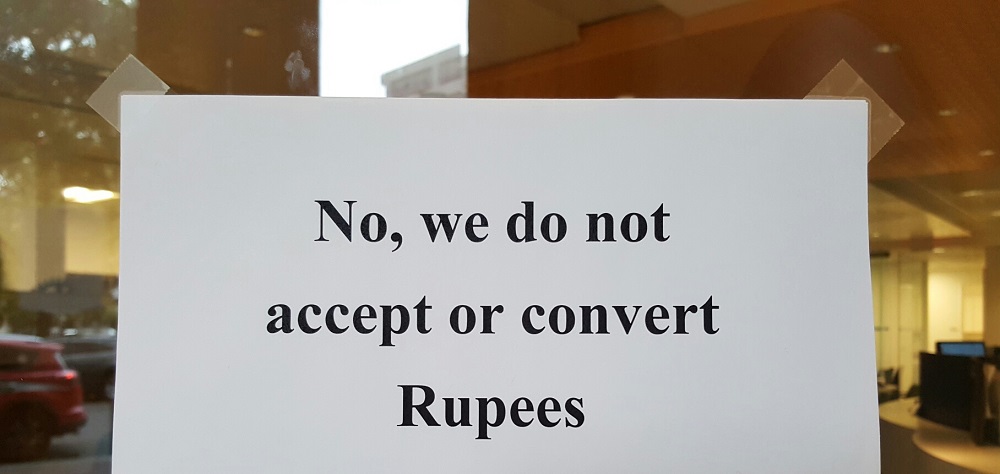

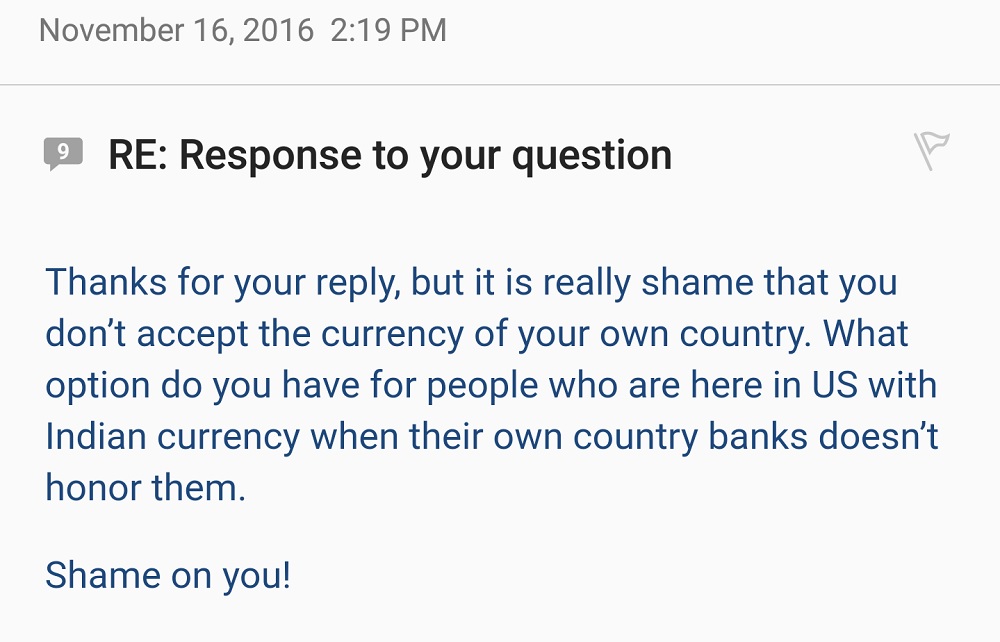

I work for a bank based out of India operating in the US and people who relied on the black money currency want to deposit it before it becomes worthless. In the morning, I usually find up to 100 messages from the night before and during the day, sometimes all four lines are ringing simultaneously. And then there are walk-ins. Yesterday, one person came in with a grocery bag overflowing with rupees. Today, I got yelled at in person, which I guess was at least a change from getting yelled at on email.

The 22 billion banned currency notes represent 85% of the cash in circulation in India, which is an overwhelmingly cash-based economy. This change represents a challenging overhaul, but it is intended to move away from untaxed, below board exchanges to benefit the modernization of the country in the long run. Experts say, this decision will make or break Modi’s tenure as Prime Minister.

Despite many rumors about which banks do or do not accept or exchange rupees in the United States, the fact is, they are not legal banking tender in the United States of America. Not even our bank, even with the word “India” in the bank’s name, takes deposits in Indian money. We are regulated by the U.S. authority and do business in U.S. currency just like any other bank here.

So where does the confusion arise? Some banks offer something called foreign currency accounts, but they are often for high premiums, only for competitive foreign currencies, and require vetting processes for high level investors in the international market.

Additionally, The Reserve Bank of India (RBI) says that Indians could deposit the bills in non-resident ordinary rupee accounts, a type of bank account where people living abroad park income earned in India. However, even if you do have a non-resident ordinary rupee account that account is still located in India and not in the U.S. Therefore, you still have to travel to India in order to make that cash deposit.

One of the clearest options for overseas Indians is to travel back to India to exchange the notes in person. Indians will be able to exchange their old notes for new ones at the country’s banks until December 30. Overall, the difficult reality is that U.S. banks do not operate on these notes, and there is little the banks can do. I hope this clears up the confusion that people might have.